On 24 February 2025 the European Banking Authority published a Report assessing the availability and accessibility of data related to environmental, social and governance (ESG) risks, as well as the feasibility of introducing a standardised methodology for identifying and qualifying credit exposures to such risks.

Following the legal mandate under Article 501c(1) of the Capital Requirements Regulation, the Report presents institutions’ existing practices and identifies the current challenges in standardising the identification and classification of exposures to ESG risks, based on observations related to data quality and collection, assessment methodologies, and available regulatory guidance.

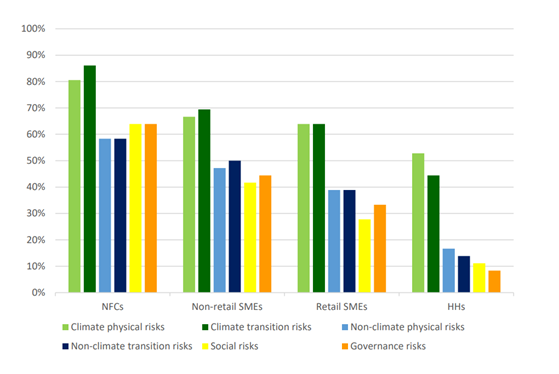

For the preparation of the Report, the EBA collected input from a sample of 26 institutions across 14 countries of the European Economic Area (EEA) and focused on the following exposure classes: non-financial corporates (NFC), small and medium enterprises (SMEs) and mortgage exposures to households (HH). Figure 2 of the Report depicts the overall findings across the different exposure classes.

Figure 1: Institutions having a methodology to identify ESG risks and to possibly qualify exposures subject to them. Source: Report, page 19.

The survey results reveal that institutions generally focus their methodologies on identifying and qualifying ESG risks almost exclusively on mortgage loans, where the assessment is based on the immovable property collateral. According to the Report, most institutions appear to use physical and transition risk indicators, based on the physical hazards and the energy performance of buildings. The scores based on these indicators aim to help assess the potential impact of climate risk on the credit quality of borrowers and potential losses from mortgage exposures.

The Report points out that, to address remaining issues on the availability and accessibility of ESG data, institutions use a combination of internal and external data sources, including internal loan data, external climate data, third-party environmental ratings and public databases.

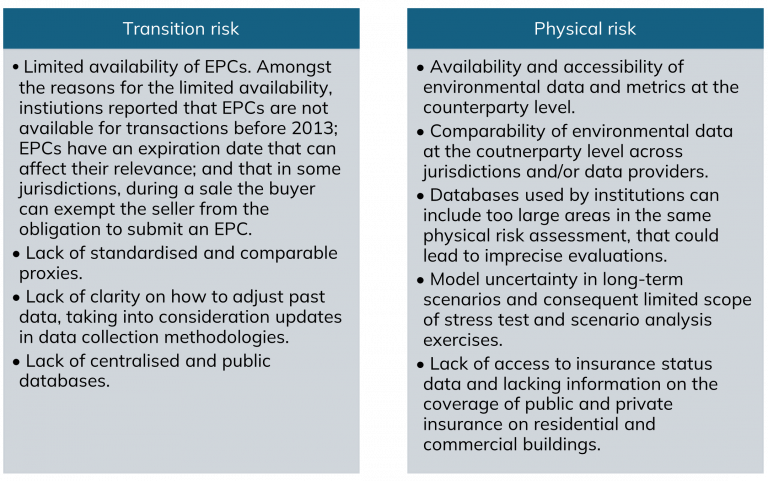

Nonetheless, institutions claimed that it is challenging for them to compare and aggregate comparable data on environment-related metrics across different jurisdictions, data providers, and data sources, due to the lack of common standards and definitions. In addition, some institutions stated that the lack of technical expertise and regulatory guidance can lead to difficulties in developing and applying consistent and transparent methodologies and frameworks to assess the physical and transition risks of different sectors and regions.

Table 1: Challenges mentioned by institutions for transition and physical risk.

The institutions participating in the survey proposed five suggestions to address the above-mentioned challenges, namely:

The institutions believe that the implementation of these suggestions would contribute to bridging the existing data gap, precisely:

The EBA Report further includes a “Complementary analysis” with considerations based on additional desk work and experience within the supervisory community beyond the results of the survey.

Finally, the EBA concludes that despite the positive developments experienced over the last few years, the landscape of ESG data remains incomplete at this stage for the reasons referred throughout the Report.

With regards to the feasibility of introducing a standardised methodology, the EBA concludes that it differs greatly depending on the type of exposures and risks considered. In the case of mortgage exposures, it seems feasible to develop a common methodology covering both physical and transition risks, based on the location and energy efficiency of the immovable property collateral, although the required data granularity and linkage to climate hazards may still pose specific challenges.

To achieve the proposed 55% emission reduction climate target by 2030, around EUR 275 billion of additional investments are needed per year.

© Copyright 2022-23 Engage. All Rights Reserved.