On 4 June 2024 the European Supervisory Authorities (ESAs) – the European Banking Authority (EBA), European Securities and Markets Authority (ESMA) and European Insurance and Occupational Pensions Authority (EIOPA) – published their Final Reports on Greenwashing, responding to the European Commission request for input on “greenwashing risks and the supervision of sustainable finance policies” issued in May 2022.

These Final Reports follow the Progress Reports, published in May and June 2023 by each of the ESAs.

In this article, we delve into some of the key takeaways from each of the Final Reports.

Amongst other findings, the ESMA Final Report highlights the need for access to relevant, high-quality and comparable data to ensure effective supervision. The Report shows that NCAs almost unanimously identified access to data as a challenge in at least one Sustainable Investment Value Chain (SIVC) sector, with data referring either

a) to information that is the subject of supervision (e.g., regulatory disclosures, certain advertisements); or

b) to information that can serve supervisors in their work (e.g., news reports, data on sustainability profile of funds’ underlying assets).

In the Final Report, the ESMA invites the European Commission to foster the standardisation and machine-readability of sustainability disclosures in all segments of the SIVC in order to ensure that supervisors can consume data effectively and on a large-scale basis and can implement advanced digital tools for supervision (SupTech tools).

The EBA Final Report reiterates the common high-level understanding and provides recommendations to institutions, supervisors, and policymakers.

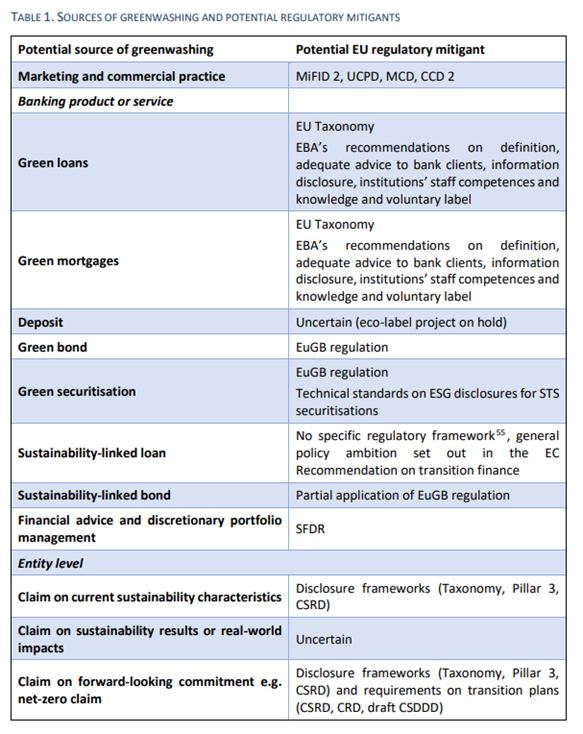

It is divided into six chapters, with chapters 4 and 5 providing valuable guidance on how to tackle greenwashing at product and entity level. The following paragraphs briefly summarise the content of these chapters.

Chapter 4: Addressing greenwashing through the EU regulatory framework

Chapter 4 of the EBA Final Report assesses how the EU regulatory framework can play a role in addressing greenwashing. In this sense, EBA acknowledges that regulatory developments in the EU have resulted in a sustainable finance framework that should contribute to preventing, identifying, and monitoring greenwashing. It achieves this by providing specific definitions and criteria and allowing for increased transparency on, and comparability of, institutions’ practices.

The core of the sustainable finance regulatory framework is the EU Taxonomy which should contribute to improving data reliability and comparability and limiting the risk of market fragmentation.

In this regard, EBA states that the role of the EU Taxonomy in mitigating greenwashing is twofold for credit institutions and investments firms:

While the regulatory framework, especially, the EU Taxonomy, can significantly contribute to tackling greenwashing, EBA notes that the first challenge identified by financial institutions in this endeavour relates to the lack of available and reliable data to comply with the new ESG disclosure requirements.

Some data related issues already identified in the Progress Report include:

a) Data and methodological gaps;

b) The need for recourse to equivalent information or estimates in the absence of sufficient data;

c) Discrepancies between regulations with regard to, e.g., the use of proxies;

d) Dependency on ESG data providers.

Chapter 5: Practices to mitigate greenwashing risks by institutions

Chapter 5 of the EBA Final Report presents principles and practices that could help institutions mitigate the risk of greenwashing. Amongst other things, this chapter provides an indicative list of tools, processes and initiatives that are considered potential mitigants to some identified drivers and types of greenwashing. These principles and practices are the basis for the recommendations addressed to institutions.

In terms of ESG data, EBA underscores the need to build sound ESG data management practices, including transparency about the ESG data sources and methodologies used by institutions and the approach applied to fill data gaps.

The EIOPA Final Report puts forward a range of proposals to address greenwashing, particularly with relation to enhancing the supervision of greenwashing and improving the sustainable finance regulatory framework.

It proposes:

The 2023 Progress Reports are available here:

To achieve the proposed 55% emission reduction climate target by 2030, around EUR 275 billion of additional investments are needed per year.

© Copyright 2022-23 Engage. All Rights Reserved.