Europe’s sustainable finance landscape is undergoing a period of significant change, driven by regulatory shifts aimed at building a more climate-resilient economy and aligning financial systems with environmental goals.

This blog looks at three recent regulatory updates: ESMA’s report on the integration of sustainability risks and disclosures, their thematic note on ESG credentials, and the European Commission’s proposed amendment to the EU Climate Law.

On 30 June 2025, the European Securities and Markets Authority (ESMA) published a report on the integration of sustainability risks and disclosures in the investment management sector. The report is framed in the Common Supervisory Action (CSA) launched in July 2023 with National Competent Authorities (NCAs).

The CSA’s aim was to assess, foster, and enforce the compliance of supervised entities with:

According to the report, the CSA results show that the level of compliance is, overall, satisfactory. However, there is still room for improvement in the level of managers’ compliance with the framework on the integration of sustainability risks and disclosures.

Building on the findings of the CSA exercise, ESMA will facilitate discussions among NCAs to foster a common supervisory culture across the EU and promote effective, sound, and consistent supervision with regard to the integration of sustainability risks and disclosures.

Click the button below to read the full report.

On 1 July 2025, ESMA published a thematic note on ESG credentials. The note is addressed to market participants with an educational objective and builds on observed market practices.

The thematic note outlines ESMA’s expectations towards market participants when making sustainability claims, leveraging the European Supervisory Authorities’ common high-level understanding along with the core characteristics of greenwashing as stated in the ESMA Progress Report on Greenwashing.

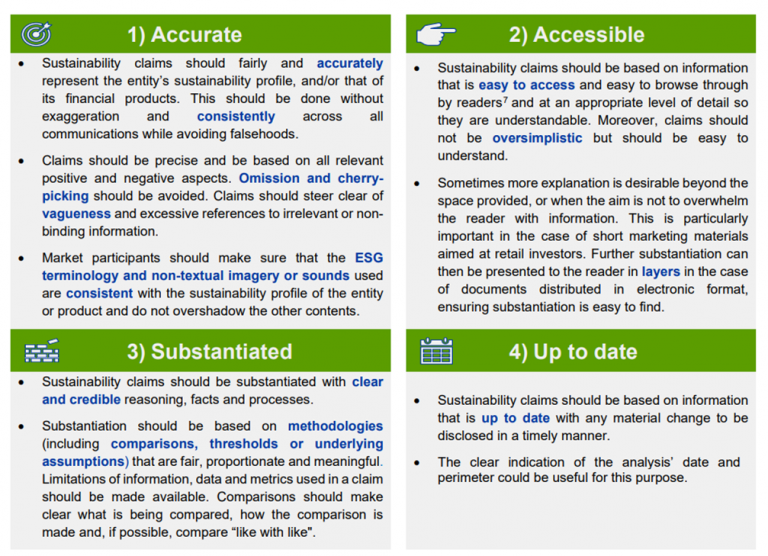

According to ESMA, “Market participants should acquaint themselves with the below four principles for making sustainability claims to ensure that all claims are clear, fair, and not misleading and thereby avoid the risk of greenwashing”.

The four principles put forward are:

Source: ESMA

The thematic note also includes guidance on how claims regarding ESG credentials should be formulated, providing practical examples applicable to claims about industry initiatives, labels and awards, comparisons to peers, and all forms of ESG credentials.

The European Commission announced the proposal of an amendment to the EU Climate Law on 2 July 2025, setting an EU climate target of 90% reduction in net greenhouse gas emissions by 2040.

The Commission proposal emphasises the importance of accelerating and strengthening the right enabling conditions to achieve the target. The proposal aligns with the EU Competitiveness Compass, Clean Industrial Deal and Affordable Energy Action Plan and is based on an in-depth impact assessment along with advice from the Intergovernmental Panel on Climate Change and the European Scientific Advisory Board on Climate Change.

The proposed amendment to the EU Climate Law includes a requirement for the European Commission to ensure that investment needs and opportunities, including access to public and private finance, are properly reflected in EU legislative proposals.

The Commission’s proposal setting a 2040 climate target will be submitted to the European Parliament and the Council of the European Union for discussion and adoption under the ordinary legislative procedure.

To read the full press release, please click below.

To achieve the proposed 55% emission reduction climate target by 2030, around EUR 275 billion of additional investments are needed per year.

© Copyright 2022-23 Engage. All Rights Reserved.