Technical Report on Risk Mitigation Correlation Analysis: An Overview

The exploratory data analysis revealed a clear link between higher energy efficiency and credit-positive borrower characteristics. Borrowers residing in highly efficient dwellings exhibited higher median incomes and lower debt-to-income (DTI) ratios, indicative of greater financial resilience. Importantly, subsequent modeling confirmed that energy efficiency operates not merely as a proxy for borrower wealth but as an independent and critical risk factor influencing default probability. These results highlight the material relevance of energy efficiency in assessing mortgage credit risk and support the inclusion of sustainability indicators within future credit risk evaluation frameworks.

The analysis relied on loan-level data from the European DataWarehouse (EDW) database and focused on three key areas: the Netherlands, France and a consolidated “rest of Europe” category that aggregates smaller markets like Belgium, Austria, Portugal, Finland and Ireland.

The study has been conducted over an extensive EDW dataset corresponding to approximately 531,000 individual loans over the 2021-2025 period.

This blog aims to provide some high-level insights of the Technical Report, especially focusing on the energy efficiency distribution and the borrower and loan characteristics per regional group.

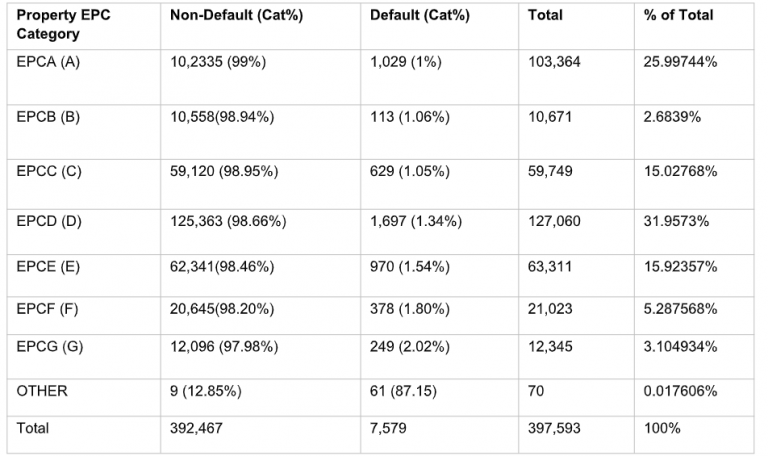

For France, the available energy efficiency distribution is dominated by mid-range efficiency levels, with classes D (32%) and A (26%) being the most prevalent.

The pattern of default risk follows a clear upward trajectory as efficiency declines: properties rated A and B record the lowest proportion of defaults (around 1%), while those rated F and G reach 1.8-2.0%, and poorly classified “other” properties default at exceptionally high levels (87%).

This finding underscores the expected relationship between building performance, operating costs, and repayment capacity.

Classification of Mortgages by energy efficiency Certificate Value and Default Rate (France)

Borrower and loan characteristics

The portfolio composition is broadly consistent with the overall pattern: property purchase loans account for 85.7% of the total loans, followed by construction loans (12.4%) and renovation loans (1.9%). Default rates are low and homogeneous across purposes, with both purchase and construction loans showing identical rates of 1.29%. Renovation loans display a slightly higher risk (1.85%), suggesting moderate exposure to project execution or liquidity constraints among borrowers engaging in property improvements.

Houses dominate the mortgage pool (≈74%) and display moderate default rates (circa 1.4%), while flats—though fewer in number—show slightly lower risk at (circa 1%).

In France, private sector employees (EMRS) represent over 62% of all mortgages, followed by public sector employees (EMBL) with around 23%, while the self-employed (SFEM) account for roughly 9%. The French data also reveals clear risk stratification: legal entities (NOEM) and public sector workers show the lowest default rates (below 1%), whereas students and the unemployed display much higher risk profiles—27.27% and 3.08%, respectively—suggesting the role of employment stability in loan performance.

Energy efficiency (RREC10) distribution

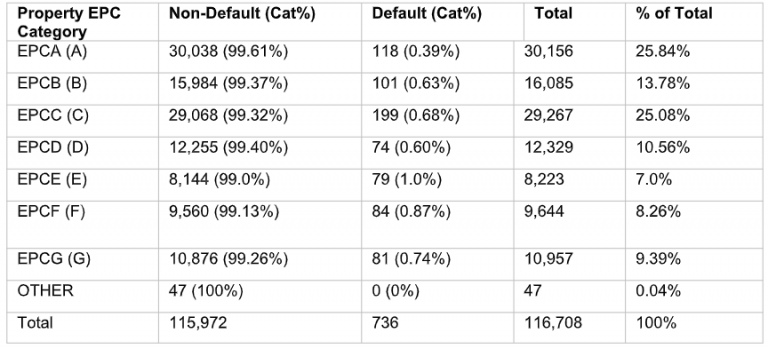

In the Netherlands, the portfolio skews towards high efficiency, with categories A, B and C jointly accounting for nearly 65% of all mortgages. Default rates remain exceptionally low and highly clustered -below 1% across nearly all energy classes – suggesting both strong underwriting standards and the prevalence of an energy-efficient housing stock. Notably, even the least efficient properties (G) exhibit default rates below 1%, a finding that reflects both economic stability, fiscal incentives and a well-regulated mortgage environment.

Classification of Mortgages by energy efficiency Certificate Value and Default Rate (Netherlands)

Borrower and loan characteristics

In the Netherlands, purchase loans remain dominant (87.4%), but remortgages form a more significant share (7.8%) compared to France. Defaults are uniformly low across all categories -below 1% in most cases- with construction loans performing best (0.88%) and equity release or renovation loans marginally higher (1.3-1.9%). This consistency in low risk suggests robust borrower selection and a stable macroeconomic environment.

In the Netherlands, detached and semi-detached houses again form the bulk of the portfolio (≈86%) with the lowest default rates (≈0.6%), whereas flats and other dwelling types present marginally higher rates near 0.9%.

The dominance of the Unknown sector in data is more pronounced, representing over 70% of total mortgages (EMUK), while public sector employees (EMBL) are nearly absent. Here, default rates remain generally low across categories, with self-employed and pensioners (SFEM and PNNR) showing moderate risk levels around 0.5–0.6%, and the unemployed recording the lowest default rate of 0.14%, possibly reflecting strong social safety nets and institutional safeguards in the Dutch mortgage market.

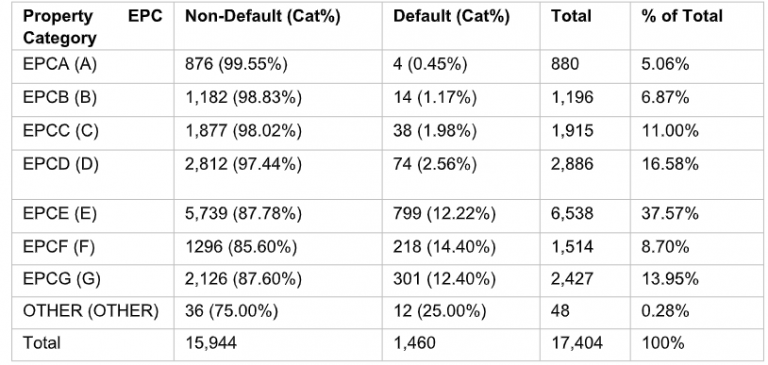

Classification of Mortgages by energy efficiency Certificate Value and Default Rate (Rest of Europe)

Borrower and loan characteristics

Purchase loans still dominate (96.0% of total mortgages) but are associated with a default rate near to 10%. Other purposes -such as construction, renovation, or remortgage with equity release- represent negligible volumes but record extremely high default ratios (often above 90%), reflecting either idiosyncratic borrower stress or very small, high-risk portfolios. These outcomes highlight the divergence in credit performance across European markets, likely shaped by differences in institutional quality, underwriting standards, and economic stability.

Flats account for almost half of all mortgages (≈48%) and exhibit a markedly higher default rate (≈15%). Bungalows also show elevated default risk (≈11%), and even detached or terraced houses experience default rates between 2% and 5%. This disparity points to weaker portfolio quality and potentially higher regional exposure to economic or market volatility outside the core EU markets.

In the “rest of Europe” category, there is a heavy representation of private employment (EMRS, 45%) but also higher heterogeneity and risk dispersion. Default rates are substantially elevated, averaging around 9-10% for private employees and surpassing 18% among pensioners. Vulnerable groups such as students and the unemployed show particularly high default rates (27.27% and 37.85%, respectively), while legal entities and the self-employed perform better but still face elevated risk.

To achieve the proposed 55% emission reduction climate target by 2030, around EUR 275 billion of additional investments are needed per year.

© Copyright 2022-23 Engage. All Rights Reserved.