The ENGAGE Portal aims to help lending institutions comply with sustainable finance disclosure reporting and to assess and manage climate-related risks relating to mortgages and home renovation loans. In doing so, the ENGAGE Portal seeks to enhance transparency regarding the sustainability degree of financial products to stimulate sustainable investments.

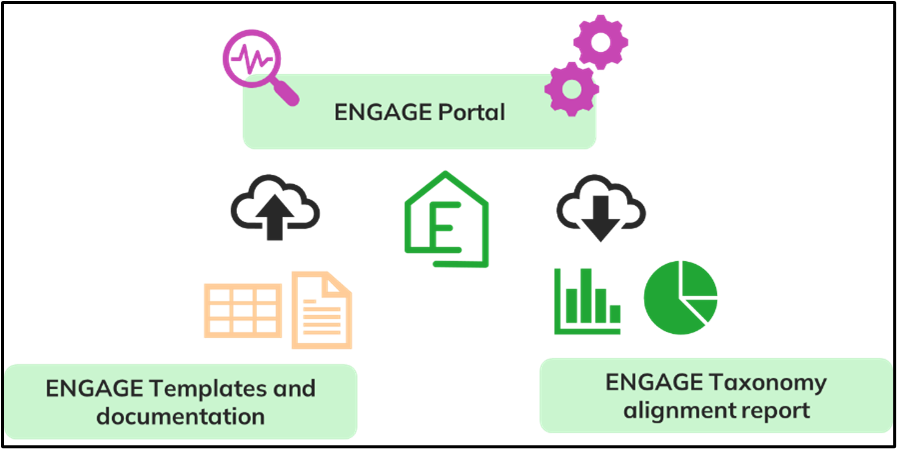

Lending Institutions will be able to upload, validate, and manage data relating to mortgages and home renovation loans in the ENGAGE Portal in compliance with specific reporting obligations.

The ENGAGE Portal will leverage the technological expertise and established IT infrastructure offered by Consortium partners European DataWarehouse and Hypoport, who aim to release the Portal beta testing in 2024.

Two Consortium pilots Unión de Créditos Inmobiliarios and Woonnu will be the first lending institutions to compile the ENGAGE Templates and test the ENGAGE Portal.

All European banks and lending institutions are encouraged to register as Test Users of the ENGAGE solution free of charge until October 2025 following the simple steps below:

For more information, contact the initiative coordinator at: engage4esg@eurodw.eu.

The ENGAGE Consortium’s ‘Unlocking the ENGAGE Templates Webinar Series’ explores the nuances of the ENGAGE Templates and how they will help lending institutions identify the relevant climate-related data to align their mortgages and home renovation loans with the EU Taxonomy.

Please click below to access the webinar content.

To achieve the proposed 55% emission reduction climate target by 2030, around EUR 275 billion of additional investments are needed per year.

© Copyright 2022-23 Engage. All Rights Reserved.